Vian Capital offers a comprehensive platform for loan, credit Card & Insurance services, focusing on a wide network of lending partners, experienced advisors, and a user-friendly online process. Given your recent interest in various business models, marketing strategies, and the financial sector, some of these features might be particularly noteworthy.

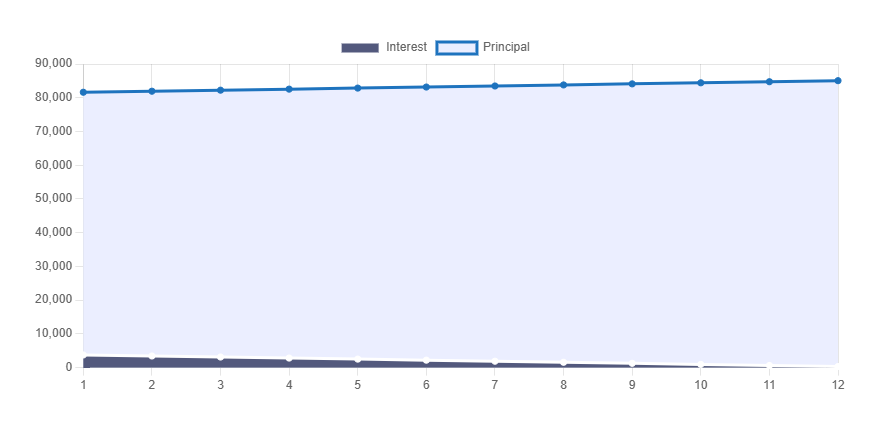

Total Investment ₹0

Future Value ₹0

Wealth Gain ₹0

| Year | Total Investment (₹) | Future Value (₹) | Wealth Gain (₹) |

|---|

The repayment amount shown using this calculator is an estimate, based on information you have provided. It is provided for illustrative purposes only and actual repayment amounts may vary. To find out actual repayment amounts, contact us. This calculation does not constitute a quote, loan approval, agreement or advice by My Finance. It does not take into account your personal or financial circumstances.

Capital financial services refer to a range of financial products and services provided by financial institutions, such as banks, investment firms, and asset management companies. These services include:

Managing investments on behalf of individuals, companies, or institutions.

Managing assets, such as stocks, bonds, and real estate, to achieve financial goals.

Providing financial planning, investment management, and other services to high-net-worth individuals.

Helping companies raise capital through various means, such as initial public offerings (IPOs), debt financing, and private equity.

Advising companies on buying or selling other companies or assets.

Providing personalized financial planning services, including retirement planning, estate planning, and tax planning.

Helping individuals and companies manage financial risks, such as market risk, credit risk, and operational risk.

Capital financial services play a crucial role in facilitating economic growth, investment, and financial stability. They help individuals and companies achieve their financial goals, manage risk, and make informed investment decisions.

Borrowing money from a lender with the promise to repay, usually with interest. Types include personal loans, home loans, car loans, and more.

A type of revolving credit that allows you to borrow money up to a certain limit, with the option to pay back over time or in full each month.

Protection against financial losses due to unforeseen events, such as accidents, illnesses, or property damage. Types include life insurance, health insurance, auto insurance, and more.